As a business owner, having an accurate valuation of your business is crucial to strategic planning. It allows you to know when to seek investors, when to make acquisitions, and when to divest.

However, different valuation methods apply to companies at various growth stages. In this article, we shall highlight the revenue-based valuation method.

That includes explaining when the revenue-based method is appropriate, the factors that affect revenue multiples, and how to calculate business valuation.

Let’s begin.

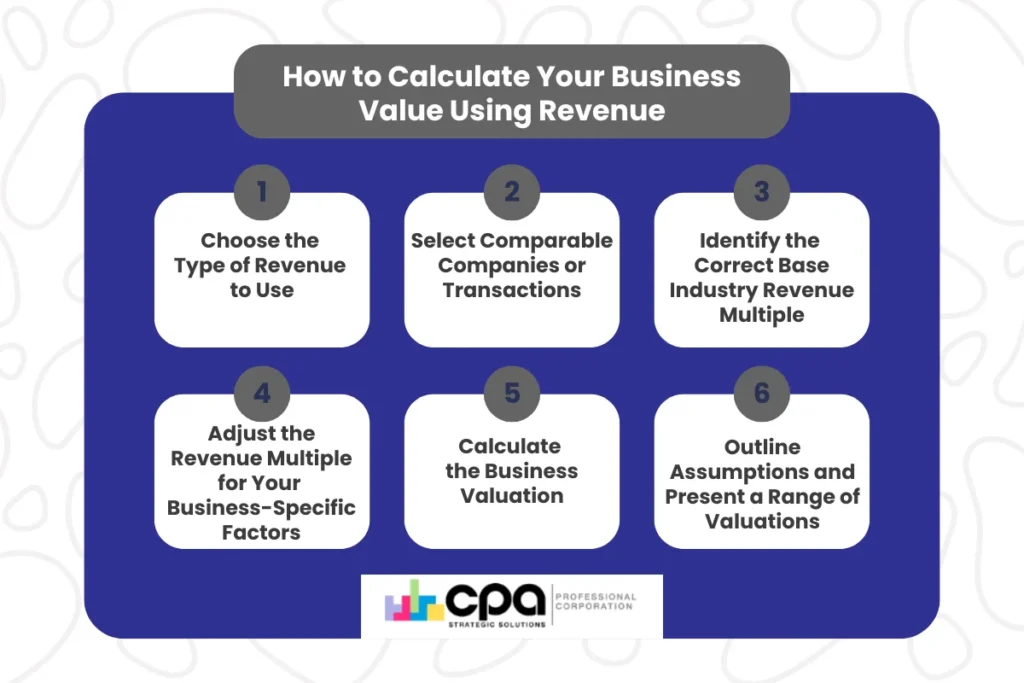

TL;DR – How to Value a Business Based on Revenue

Below is an overview of the steps you should follow when conducting a revenue-based business valuation:

- Choose the type of revenue to use

- Select comparable companies or transactions

- Identify the correct base industry revenue multiple

- Adjust the revenue multiple for your business-specific factors

- Calculate the business valuation

- Outline assumptions and present a range of valuations

If you’re interested in how to conduct each step, read on.

What is Revenue-Based Valuation and When to Use it

Revenue-based valuation is a popular method of estimating a company’s value by multiplying its revenue by an industry-appropriate multiple.

The basic formula for the process is:

Company Value =Revenue x Revenue Multiple

There are two approaches when deciding what revenue figures you will use in the formula, namely:

- Trailing Twelve Months: Uses the last fiscal year’s revenue

- Forward Projected Revenue: Uses projected revenue for the upcoming fiscal year.

The multiple you use reflects the industry in which your business operates. It also takes into account market trends, the robustness or quality of your company’s revenue, and risks to the revenue stream.

When to Use Revenue-Based Valuation

It is best to apply the revenue-based valuation method when working with:

- Businesses, such as start-ups, have high revenue but little or no profit.

- Companies operating in industries that generally value businesses based on revenue, such as software-as-a-service (SaaS) and e-commerce.

- Businesses with volatile profits or profits heavily influenced by investments, taxation, and expansion policies.

- Fast-growing companies make it challenging to use profit-based valuation methods.

- Businesses with consistent recurring revenue, such as subscription-based companies like a content streaming site.

You should not use a revenue-based valuation method if your business has stable profits or derives most of its value from assets. This is because profit-based and asset-based valuations can provide more accurate valuations in such circumstances.

Industry-Specific Revenue Multiples

Revenue multiples vary by industry, since different business models generate and grow revenue at different rates.

Let’s look at examples of sector-specific revenue multiples:

| Industry | Multiple | Drivers |

| SaaS and Software Companies | 3x to 12x | Stable subscriptions High gross margins |

| Retail | 0.3x to 1x | Gross margins Inventory size |

| eCommerce | 0.5x to 3x | Gross margins Inventory intensity |

| Professional services | 0.5x to 1.5x | Billable client base Profitability |

| Manufacturing | 0.5x to 1.5x | Asset size Capital investment requirements |

| Healthcare and Biotech | 1x to 4x | Cash flows Clinical-stage adjustments |

The ranges within each industry vary to accommodate factors that may affect the exact multiples for each unique company. You can use multiple recent, comparable transactions, including those from public companies, as a starting point.

However, you must adjust the multiples to reflect the differences between your company’s liquidity and size and that of a public company.

Key Factors That Influence Your Revenue Multiple

Revenue multiples are not just random figures; getting to the correct figure for your company is a process influenced by several internal and external factors.

Here are the crucial factors that affect your revenue multiple:

- Growth Rate: If your company has a high and consistent growth rate of, say, 30% to 50% annually, you can justify using a high multiple. This is because a sustained growth rate influences future cash flows. On the other hand, a stagnant or declining growth rate calls for a lower multiple.

- Gross Margins: Even though profits are not in the formula for a revenue-based valuation, they can have a significant bearing on the multiple. A high gross margin is an indicator of operational efficiencies and scalable revenue, thus commanding a higher multiple.

- Revenue Mix: Your business could have recurring revenue, for example, from contracts and subscriptions, as well as non-recurring revenue. Recurring revenues contribute to a higher multiple because they are predictable and indicate growth potential.

- Customer Retention: If your business relies on a subscription model, a high customer retention rate is vital. It indicates high customer loyalty, which translates into reliable revenue and hence justifies a high multiple.

- Customer Concentration: A high dependency on a few customers negatively affects the multiple. For example, if one client accounts for more than 20% of your revenue, it poses a risk to your company’s stability, so you should apply a low multiple.

- Market Size: If you operate in an expanding market, your multiple should be high since there is growth potential for your company. However, if your market is small, saturated, or shrinking, you should use a low multiple to reflect the stifling effect of its size on growth potential.

- Competitive Position: If the market you operate in has high barriers to entry and your company has a strong brand, you can raise your multiple. This is because your company is unlikely to lose its competitive advantage, which is attractive to investors.

- Intellectual Property: Having access to high-value intellectual property, such as patents, trademarks, and unique processes, can substantially increase your company’s revenue multiple. This is because such IP can generate sustained, predictable revenue.

Step-by-Step – How to Calculate Your Business Value Using Revenue

Now, let’s walk through the step-by-step process for calculating your company’s value using revenue as the primary metric.

1. Choose the Type of Revenue to Use

Most valuation experts use one of these three valuation metrics:

- Latest Fiscal Year Revenue

- Trailing Twelve Months Revenue (TTM)

- Forward Projected Revenue

Forward-projected revenue works best with fast-growing businesses with reliable forecasts.

On the other hand, TTM is the most commonly used because it is objective and adjusts figures to accommodate the effect of seasons on revenue.

2. Select Comparable Companies or Transactions

Identify public companies in your industry with comparable financial data. You should also find private M&A deals in your sector between companies with comparable data and operating at a similar growth stage and geographic market to your company.

Then take note of the revenue multiples they used in their valuations.

3. Identify the Correct Base Industry Revenue Multiple

Using the data from comparable companies or transactions, calculate the mean and median of their revenue multiples and use the figures obtained as a starting point.

Remember to adjust downward the multiples used by public companies to reflect the liquidity issues and smaller size associated with private companies.

4. Adjust the Revenue Multiple for Your Business-Specific Factors

Identify factors that can influence your company’s revenue multiple. For example, your company’s growth rate, margins, market size, competition, customer churn rate, and other risks. Then apply upward or downward adjustments, depending on how each factor affects the multiple.

For example, a high growth rate means raising the revenue multiple, while a high customer churn rate means lowering it.

5. Calculate the Business Valuation

The formula is:

Business Value = Revenue x Revenue Multiple

For example, if you have a TTM revenue of $3,000,000 and your chosen revenue multiple is 3.5, then the value of your company would be:

$3,000,000 x 3.5 = $10,500,000

6. Outline Assumptions and Present a Range of Valuations

List all assumptions made during the selection of the revenue multiple. Then show how the valuation fluctuates with different revenue forecasts and selected multiples.

Run the following scenarios:

- Conservative Projections: For worst-case scenarios with low growth, keep the multiple low.

- Realistic Projections: Uses the standard industry multiple to produce the likeliest valuation outcome.

- Optimistic Projections: Used when one is bullish about growth rates, leading to a high revenue multiple.

Understanding the factors that influence revenue multiples gives you the foundation you need for business valuation. But executing an accurate valuation requires a systematic approach that accounts for your company’s unique position.

Whether you are looking to sell your business right away or preparing for an exit in the next three to five years, partner with an M&A expert. At JS CPA Strategic Solutions, we offer business valuation optimization, financial reporting and forecasting, and exit readiness assessment, so you don’t leave money on the table.

Let’s start working on your business valuation. Schedule a call today.

Common Mistakes in Revenue-Based Valuation (and How to Avoid Them)

Revenue-based valuation may seem like a straightforward process.

However, there are several pitfalls you should be wary of, including:

- Failure to Normalize Financials: Many business owners forget to normalize their financials before beginning the valuation process. This can lead to skewed figures that do not accurately reflect your business’s value. To avoid such an outcome, remove non-recurring revenue and one-time gains, and adjust for seasonal revenue disruptions.

- Misapplying Industry Multiples: Each industry has a range of multiples; however, many business owners apply the wrong multiple within the range. For example, using the multiple of a large public company to a small private company. Therefore, it is essential to apply unique metrics that affect your company to multiple calculations to obtain the correct figure. For instance, in a private company, you should factor in company size and liquidity discounts.

- Ignoring Profitability: Just because the method values revenue does not mean you should ignore profits. Profits are a crucial factor in calculating the revenue multiple. Therefore, ensure you include profitability in your revenue-based valuation.

- Failing to Adjust for Customer Base: Some people may overlook the importance of your customer base during the valuation process. You must consider customer concentration. For example, if your business is reliant on a single major customer, you should apply a lower multiple, as overreliance is risky unless you can justify it with major contracts.

- Failing to Consider Yearly Trend: Many businesses use the same revenue multiple year after year without adjusting for year-over-year trends. For instance, if your revenue for the current financial year is lower than the previous year, then you should lower the multiple to obtain an accurate valuation.

- Using Unrealistic Forecasts: When using the forward-projected revenue approach, it is easy to get carried away and make overly optimistic growth projections. This is risky because it will inflate the valuation and affect other financial statements. It is essential to rely on historical figures and market trends to make realistic forecasts.

- Having Disorganized Financial Statements: Messy financial statements are a red flag for many investors because they signal unreliability. Consequently, it lowers your company’s valuation due to the unreliable data. To counter this, ensure you keep meticulous records and have several copies as a safeguard.

When is the Best Time to Hire a Business Valuation Expert

To avoid the above issues, a professional valuation expert is crucial for obtaining accurate, reliable figures.

They’re also valuable in situations such as:

- Business Sale: When preparing to sell your company, hiring a business valuation expert will help you demand a fair price and give you an edge in negotiations.

- Mergers and Acquisitions: Such deals often require thorough due diligence to avoid costly mistakes, which is why it is vital to hire professional valuation experts.

- When Raising Capital: During the growth stage of start-ups or an IPO for established companies, investors often require professionally audited valuations to inform their decision-making.

- Legal Purposes: If you are facing legal disputes with shareholders or getting divorced, a formal business valuation is necessary to help draft agreement terms.

- Tax Purposes: A professional valuation can help you resolve any tax disputes and receive tax compliance certifications.

- Estate Planning: A business valuation expert will accurately value your business, which will help you decide how you will divide its shares among your next of kin.

- Complex Revenue Structures: Having several diverse revenue streams, such as business-to-business, business-to-consumer, and multiple areas of operations, makes it challenging to value your business. A professional valuation expert will help you determine the appropriate multiple to use for such a complex revenue structure since you cannot rely on a simple multiple to capture actual value.

Hiring a business valuation expert is necessary if your business has a value exceeding six figures.

With our M&A advisory services, we can provide deep insight into industry guidelines, identify comparable companies, and produce credible reports for regulators and investors.

Frequently Asked Questions (FAQs)

For answers to common questions we receive from our clients, read on.

Is a Business Valuation Based on Revenue or Profit?

Business valuations can be based on both revenue and profit. Revenue-based valuations use sales as the primary factor influencing a company’s value. Early-stage companies with low profitability commonly use such valuations.

On the other hand, profit-based valuations use earnings as the anchor of value calculations. They are common in companies with stable and predictable profits.

Can a Business with Low or Negative Profits Still Have a High Valuation?

Yes, businesses with low or negative profits can have high valuations. Earnings are not the only factor that influences company valuations.

Valuation experts also consider revenue, growth potential, and future profitability in their calculations.

What Factors Can Affect a Revenue-Based Business Valuation?

Numerous factors can influence a revenue-based business valuation.

They include growth trajectory, margins, customer loyalty, industry trends, competitors, and the quality of your management team.

Conclusion

The revenue-based valuation method is ideal for fast-growing, early-stage, and low-profit businesses. It is a simple method that requires meticulous research and careful selection of factors, such as comparable companies, transactions, and revenue types.

Once you carefully select these contributing factors, it becomes easier for you to produce credible business valuations that can be leveraged in deals such as acquisitions.

However, the difference between a defensible valuation and leaving millions on the table often comes down to how well you conduct the process, which is why you should work with an M&A expert.

Partner with us at JS CPA Strategic Solutions and leverage our 10+ years of experience in M&A advisory expertise. We provide due diligence and business valuation optimization so you can approach the negotiation table with confidence.

Schedule your business valuation strategy meeting today and discover how to maximize your company’s worth.